Who Needs Helicopters? Draghi Plans "Fool-Proof" ECB-Backed Debit Card

Via Mint's Bill Blain's Morning Porridge,

”A common mistake when trying to design something completely fool-proof is to underestimate the ingenuity of complete fools..”

Via Mint's Bill Blain's Morning Porridge,

”A common mistake when trying to design something completely fool-proof is to underestimate the ingenuity of complete fools..”

The last time Europe had at least two consecutive months of deflation was in late 2014/early 2015 when the ECB launched its sovereign QE, and when prices staged a modest rebound into the rest of the year. One year later, it's more of the same, and as Eurostat revealed earlier today, after a headline price drop of -0.2% in February, March prices declined once more, this time by -0.1% in line with expectations, driven by a -8.7% plunge in energy prices.

Submitted by Alasdair Macleod via GoldMoney.com,

Last week, the ECB extended its monetary madness, pushing deposit rates further into negative figures.

It is extending quantitative easing from sovereign debt into non-financial investment grade bonds, while increasing the pace of acquisition to €80bn per month. The ECB also promised to pay the banks to take credit from it in "targeted longer-term refinancing operations".

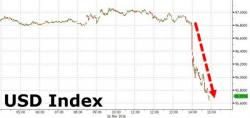

Anyone having listened, and traded according to the recommendations of Goldman chief FX strategist Robin Brooks in the past 4 months, is most likely broke. First it was his call to go very short the EURUSD ahead of the December ECB meeting, which however led to the biggest EURUSD surge since the announcement of QE1. Then, two weeks ago, ahead of the ECB meeting he "doubled down" on calls to short the EUR ahead of the ECB, the result again was a EUR super surge, the biggest since December.

Last week, we reported on the ECB’s decision to cut the interest rates and how Mario Draghi said ‘helicopter money’ is ‘an interesting concept that is being studied’. In the accompanying Q&A session, Draghi also said he did not expect the ECB would have to reduce the (already negative) interest rates even further which disappointed the markets. In fact, the disappointment was so big, the ECB already sent one of its members into the trenches to walk back on that statement.