Euro Tumbles Ahead Of Yellen, Macron Speeches As Stocks Shake Off Korean Crisis

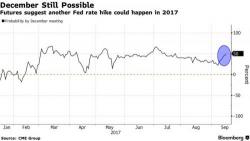

S&P futures are flat after Monday’s drop in the S&P 500 where a rout in Apple weighed on tech companies and tensions with North Korea persist; Asian stocks are modestly lower while Europe has shaken off the Korean crisis and is in the green on the back of a sharp drop in the EURUSD which has tumbled below 1.18 as the USD rises ahead of much anticipated speeches by the Fed Chair and the French president.