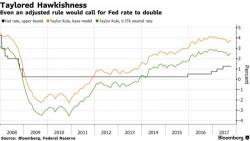

Global Stocks Just Shy Of Record Highs As Dollar, Yields Rise On Taylor Tension

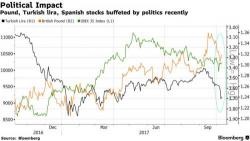

Global markets traded near all-time highs on Tuesday, with S&P futures, Asian shares and European stocks all flat this morning, while oil continued to gain on Kurdish geopolitical concerns while most industrial metals fell. The euro extended its recent slide and stocks drifted as Spain’s escalating hard-line response to the Catalonian secession threat fueled concern the crisis may intensify.