Gold, Euro Slump As Merkel Admits "New Elections Are The Better Way"

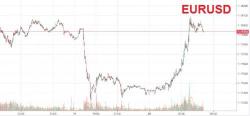

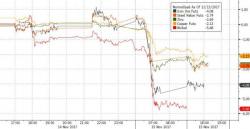

EURUSD is testing overnight lows (and gold is tumbling) after German Chancellor Angela Merkel said she would prefer to go ahead with new federal elections rather than try to form a minority government.

Seeking her fourth term, Bloomberg reports that Merkel is “skeptical” about a minority government as it may not bring about necessary stability and is open to another so-called grand coalition with the Social Democratic party, she said in an interview with ARD television.