What David Samuels Wants: Better Readers

I have to admit, I found David Samuels’s defense of his now-infamous New York Times Magazine article to be delightfully amusing. From my perspective, the important paragraph of his defense is this one:

I have to admit, I found David Samuels’s defense of his now-infamous New York Times Magazine article to be delightfully amusing. From my perspective, the important paragraph of his defense is this one:

Since the end of the Cold War, we’re had a lot of very instructive experience in the Middle East. Back in 2010, I compiled the real-time analyses I had made of our policies and their results in a book titled America’s Misadventures in the Middle East. The book holds up well as an explanation for the origins and evolution of most of our difficulties in the region. Unfortunately, both the situation in the Middle East and our position there have continued to deteriorate.

In yet another paradoxical move that will leave many scratching their heads, just days after throwing in the towel on its bullish dollar call (now that it expects far less rate hikes over the next year), Goldman moments ago announced that it is also cutting back on its longer-term oil price forecasts (which paradoxically are linked to a stronger dollar) for the coming year, as a result of a rebalancing that is taking far longer to take place than previously anticipated.

This is how Goldman explains its bearish pivot on crude:

Submitted by Irina Slav via OilPrice.com,

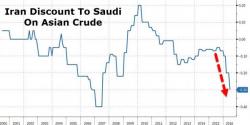

Iran has extnded its discount on the June contract for its heavy crude going to Asia, just a few days after Saudi Arabia announced a price increase for its own June contract for the continent. With this new discount, Iranian oil will be noticeably cheaper for Asian clients than both Saudi and Iraqi crude.

Submitted by Eugen von Bohm-Bawek via Bawerk.net,

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple.