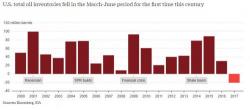

Goldman has done it again: less than two weeks after the bank said "oil prices have likely hit bottom of the price range, and look attractive" when it slashed its WTI price target from $55 to $47.50 (and every other Wall Street bank promptly followed), in a note released overnight by its analysts including Damien Courvalin and Jeffrey Currie, the central banker incubator has effectively thrown in the towel, and writes that while its 3 month base case price target remains$47.5, it warns that absent a "shock and awe" production cuts from OPEC, oil could tumble below $40/barrel