Will Venezuela Be The Battleground In The Next U.S.-Russia Proxy War?

Via TheAntiMedia.org,

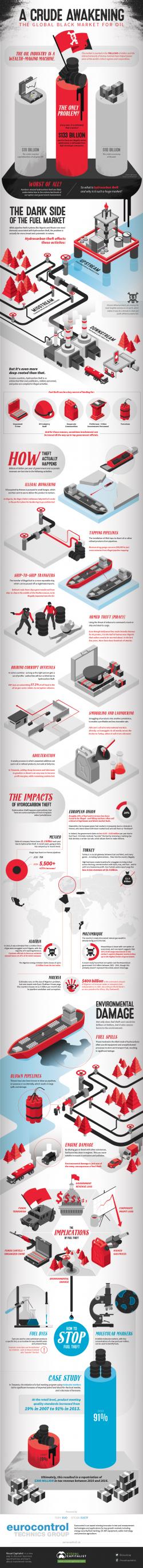

There’s no denying that Venezuela is deeply embroiled in a significant crisis. While most are aware of the country’s recent string of violent protests, food shortages and government crackdowns on opposition protesters, few are aware of the opposition’s use of underhanded and downright illegal tactics, as well as the United States’ role in funding opposition forces.