Falling Interest Rates Have Postponed "Peak Oil"

Authored by Gail Tverberg via Our Finite World blog,

Authored by Gail Tverberg via Our Finite World blog,

Authored by Charles Kennedy via OilPrice.com,

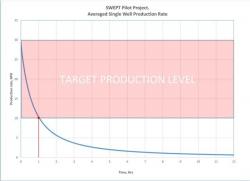

Just when you thought there couldn’t be any more oil in Texas … new technology is about to unlock an extremely shallow field that is brimming with heavy oil that has been impossible to recover--until now.

Many oil companies have spent many millions of dollars trying to unlock this gem, but expensive steam injections weren’t efficient enough to make it competitive or economic, even if they had succeeded.

Authored by James Durso via OilPrice.com,

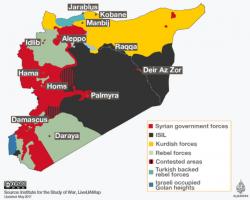

It’s the 101st anniversary of the Sykes–Picot Agreement and, in light of the non-stop Syrian Civil War, it’s time to ask, “How’s that working out for you?”

Authored by Byron King via DailyReckoning.com,

China is currently modifying the terms of its oil trade with Saudi Arabia. Specifically, China is working on a deal to pay for Saudi oil using Chinese yuan. This effort poses a direct threat to the security of the dollar.

If this China-Saudi deal happens — yuan for oil — it’s another step closer to the grave for the petrodollar, which has dominated global finance since 1974. You can revisit Jim Rickards article about the Assault on the Dollar, here.

The stabilization of oil prices in the $50-60/bbl range was meant to have one particular, material impact on Saudi finances: it was expected to stem the accelerating bleeding of Saudi Arabian reserves. However, according to the latest data from Saudi Arabia’s central bank, aka the Saudi Arabian Monetary Authority, that has not happened and net foreign assets inexplicably tumbled below $500 billion in April for the first time since 2011 even after accounting for the $9 billion raised from the Kingdom's first international sale of Islamic bonds.