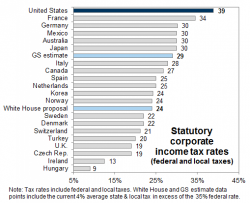

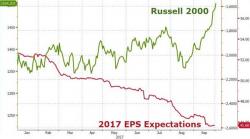

While many US companies, especially those in the Russell 2000, have seen their stocks surge in recent days on renewed hopes that Trump tax reform may pass in the coming months (Goldman assigned a 65% probability of Trump tax passing), the reality is that for a vast majority of US corporations a tax cut to 30% or even 25% will have little marginal impact: after all, while US companies may have some the highest statutory tax rate in the world...

... the effective tax rate of the median S&P 500 company is 12% below the statutory rate, or roughly 27%: