SocGen: "Global Earnings Are Back To 2014 Levels; Stocks Are 15% Higher"

Is it QE or is it earnings?

Is it QE or is it earnings?

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...

The dollar rally paused on Friday and looked poised to finish its best weekly gain of the year with a whimper, when in a repeat of the Thursday session the, Bloomberg dollar index first rose more than 0.1% during Asia hours before slumping around the European open as month and quarter-end flows came into play again.

Odd day. Low volume, small range in stocks. Good macro. Some questions over just how 'miraculous' Trump's tax plan will be for the middle-class... but the day's trend across FX, bond, and commodities was set early on when Asia closed and dollar-sellers, bond-buyers, and precious-metal-purchasers came back to play...

Risk is "Contained"...

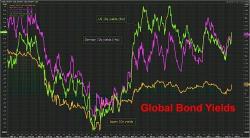

In a continuation of trading patterns observed over the previous two days, on Thursday the global bond rout deepened in the aftermath of the release of President Trump’s tax-cut plan, Janet Yellen's recent hawkish comments and renewed optimism over the health of the U.S. economy.