European Stocks Soar, US Futures, Euro Jump After Failed Italian Referendum

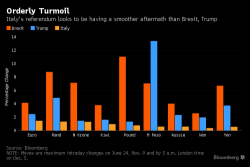

Blink, and you missed the "sell off" from Italy's failed referendum vote.

Blink, and you missed the "sell off" from Italy's failed referendum vote.

ABN Amro firing off a new note on Total SA ($TOT) this morning. The outlet is rating Total at Buy saying the oil & gas Co. has proved to be resilient (though they don't say in what manner) and also more cost efficient than most of the peers.

Looking out from my balcony I can see a ship Total leases to transport Bitumen and that little punk has been anchored for over two weeks. Maybe I don't know what cost efficiency is but I digress.

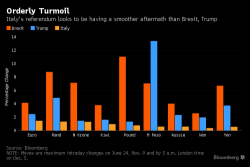

While the big move higher in the US stock market following the Trump victory - a move which it is safe to say virtually every so-called expert, with a few exceptions, called wrong - has been duly noted, and has since started to fizzle, the real story is what has happened below the market's surface, where the rotations from one sector to another in the past three weeks have been unlike anything seen in years.

Amid the slings and arrows of outrageous fortune in the stock, bond, and commodity markets this week, a few 'rotten' things began to emerge. With major indices diverging notably, new highs and new lows soaring, and breadth deteriorating, analysts noted the re-awakening of The Hindenburg Omen signal...

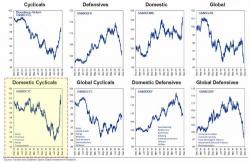

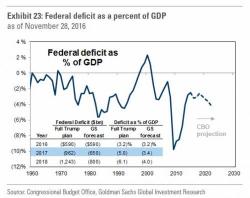

Having been on the fence about an upside case for the S&P for the greater part of 2016, Goldman's chief equity strategist David Kostin finally threw in the towel earlier this week when, as we reported, Goldman raised its S&P price target from 2,100 (as of year end 2016) to 2,400 for mid-year 2017 on what it calls "Trump Hope" (as apparently does everyone else, see "The World Has Changed" - Average S&P Target Before Trump: 2,087; After Trump: 2,425"), which it then sees dipping to 2,300 by year-end 2017 on "Trump Fear."