Gold Soars As Draghi "Dud" Unleashes Chaos In Bonds, Stocks, & FX

"You get nothing..."

"You get nothing..."

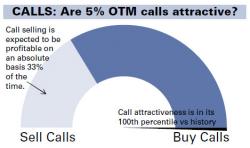

The market's volatile swing are clearly too much for the central banker-incubating hedge fund known as Goldman Sachs, because just three days after Goldman said there has "never been a better time to buy S&P calls", when it said that "our GS-EQMOVE model estimates there is a 21% probability of a 5% up-move over the next month based on the current levels of S&P 500 Free Cash Flow yield, Return on Equity, ISM new orders and US Capacity Utilization"...

... moments ago the same Goldman announced that:

Global stocks and U.S. equity futures are mostly higher this morning (despite China's historic NPL debt-for-equity proposal) as traders await the main event of the day: the ECB's 1:45pm CET announcement, more importantly what Mario Draghi will announce during the 2:30pm CET press conference, and most importantly, whether he will disappoint as he did in December or finally unleash the bazooka that the market has been desperately demanding.

"Dust off the systematic hedging strategies, and get re-acquainted with the concept of tail-risk," is the ominous conclusion from MKM Partners' Jim Strugger's latest report. Despite every effort from central banks to maintain a low-volatility environment, the magnitude of the August 2015 'shock' not just for U.S. equities but across asset classes, was great enough for Strugger to conclude that a transition into a high-volatility regime had begun.

Via ConvergEx's Nick Colas,

Today we engage in a simple thought experiment: what 3 pieces of information would you need to confidently call the 2016 end-of-year level on the S&P 500?

A brief survey of senior Convergex traders yielded this list: year-end worldwide central bank rates, Chinese GDP growth in 2016, actual 2016 US corporate earnings, the winner of the U.S. presidential race, and the pace of increases in the Fed Funds rate for the year.