Is The Bear Market Over Already?

Submitted by Lance Roberts via RealInvestmentAdvice.com,

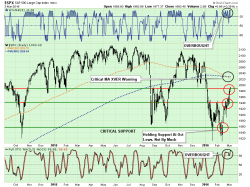

At the end of January, I discussed the potential for a reflexive rally in the markets and laid out three retracement levels at that time.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

At the end of January, I discussed the potential for a reflexive rally in the markets and laid out three retracement levels at that time.

The cracks are starting to appear in the 'paper' gold market.

BlackRock's rather shocking decisision to halt ETF creation due to gold demand (i.e. being unable to source enough physical gold to meet mandated requirements given the inflows) follows the largest gold ETF inflows since Feb 2009 (just as The Fed started QE1 and unleashed trillions of freshly digitized exuberance into the markets).

Submitted by Lance Roberts via RealInvestmentAdvice.com,

“The Bear Market Is Dead, Long Live The Bull.”

You could almost hear the chants from the always bullish biased media this week as the markets ripped higher on “first day of the month” portfolio rebalancing and short-covering by fund managers.

The rally, as discussed this past weekend, was not unexpected:

They are pulling out all the stops on this one...

Another chaotically wild week...

With the S&P 500 set to go green for the year, the best and worst performing hedge funds of the year demonstrate that while the bulk of the marquee names continue to substantially underperfom the broader market, with Tiger, Pershing Square, Glenview and Trian standing out, there are quite a few names that have generated positive results YTD.

The full breakdown of Top and Bottom 20 funds is shown below courtesy of HSBC; we will spare commentary on the fact that the year's best performing hedge fund is called the Tulip Trend Fund, a systematic trend follower.