Non-GAAP Earnings Are About To Plunge The Most Since 2009; As For GAAP Don' Even Ask...

Now that Q4 EPS is almost in the history books with 494 S&P500 companies reporting, we can look at the numbers: blended 4Q EPS is $29.49 (-2.9% y/y) with GAAP EPS of $19.92. As DB admits, a 67% GAAP-to-non GAAP ratio is well below the normal ~90% ex. recessions, exacerbated by asset impairments and restructuring costs especially at Energy.

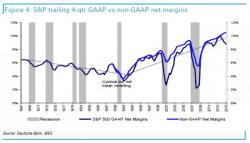

This is how DB shows this almost unprecedented divergence between GAAP and non-GAAP "earnings":