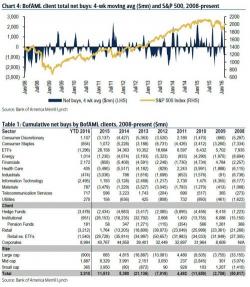

The "Smart Money" Is Quietly Getting Out Of Dodge: Sells For A Sixth Straight Week As Buybacks Soar

One week ago, when looking at the latest BofA client flow trend monitor, we noticed something strange: despite the S&P's surge higher due to either a record short squeeze or because it is merely another bear market rally, the smart money was selling.