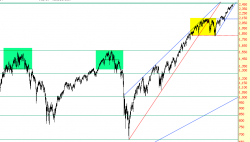

The Rollover Trio

From the Slope of Hope: Let's take a step back - -- a few thousand steps back, actually - - and drink in a very long view of the stock market. We'll use the S&P 500 as our observed entity. Here it is below, spanning several decades, with three major tops tinted.