Too Complex To Survive?

There will be no coffee and donuts in the Apocalypse (Niloo / Shutterstock.com)

Reader Ingvar writes, in a comment on a thread that’s fallen off the main page:

There will be no coffee and donuts in the Apocalypse (Niloo / Shutterstock.com)

Reader Ingvar writes, in a comment on a thread that’s fallen off the main page:

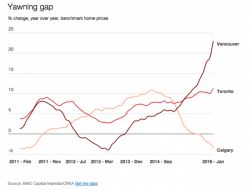

We’re starting to see some concerning developments in the luxury real estate market. First, we observed as Urbancorp, one of Toronto’s largest property developers, quietly canceled a condo complex they had been working on, and instead converting the project into rental apartments. This was one of the first signs that demand for luxury real estate is declining.

Last week, National Bank's Peter Routledge did some “back of the envelope" calculations and determined that Chinese buyers might well have accounted for one-third of all real estate purchased in Vancouver during 2015. Here’s how he came to that rather startling conclusion:

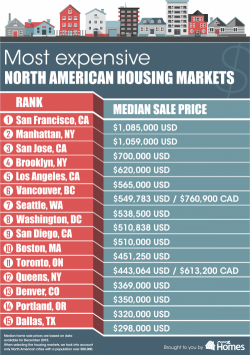

Courtesy of Point2Homes

When the average home price in San Francisco went over the $1 million threshold in the first half of 2015, it was pretty obvious for most people that the Bay city secured the top position as the most expensive housing market in the U.S. This is exactly what happened. According to records released at the end of last year, San Francisco is the superstar housing market not only in the U.S., but for the entire North America as well.

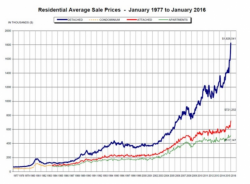

In Waterloo, Ontario, the property market is red hot.

Dubbed “Canada’s Silicon Valley,” the city of just 140,000 people is drawing interest from real estate investors far and wide. Waterloo is around 70 miles west of Toronto and is home to a Google office as well as two universities and “dozens” of startups.

One-bedroom apartments in a new development being pitched to investors are going for CAD$270,000 while a two-bedroom will run you CAD$340,000. Rents in the building are as high as $2,000/month.