Economic Disaster

Hold your real assets outside of the banking system in a private international facility --> https://www.321gold.com/info/053015_sprott.html

Economic Disaster

Posted with permission and written by Rory Hall of The Daily Coin (CLICK FOR ORIGINAL)

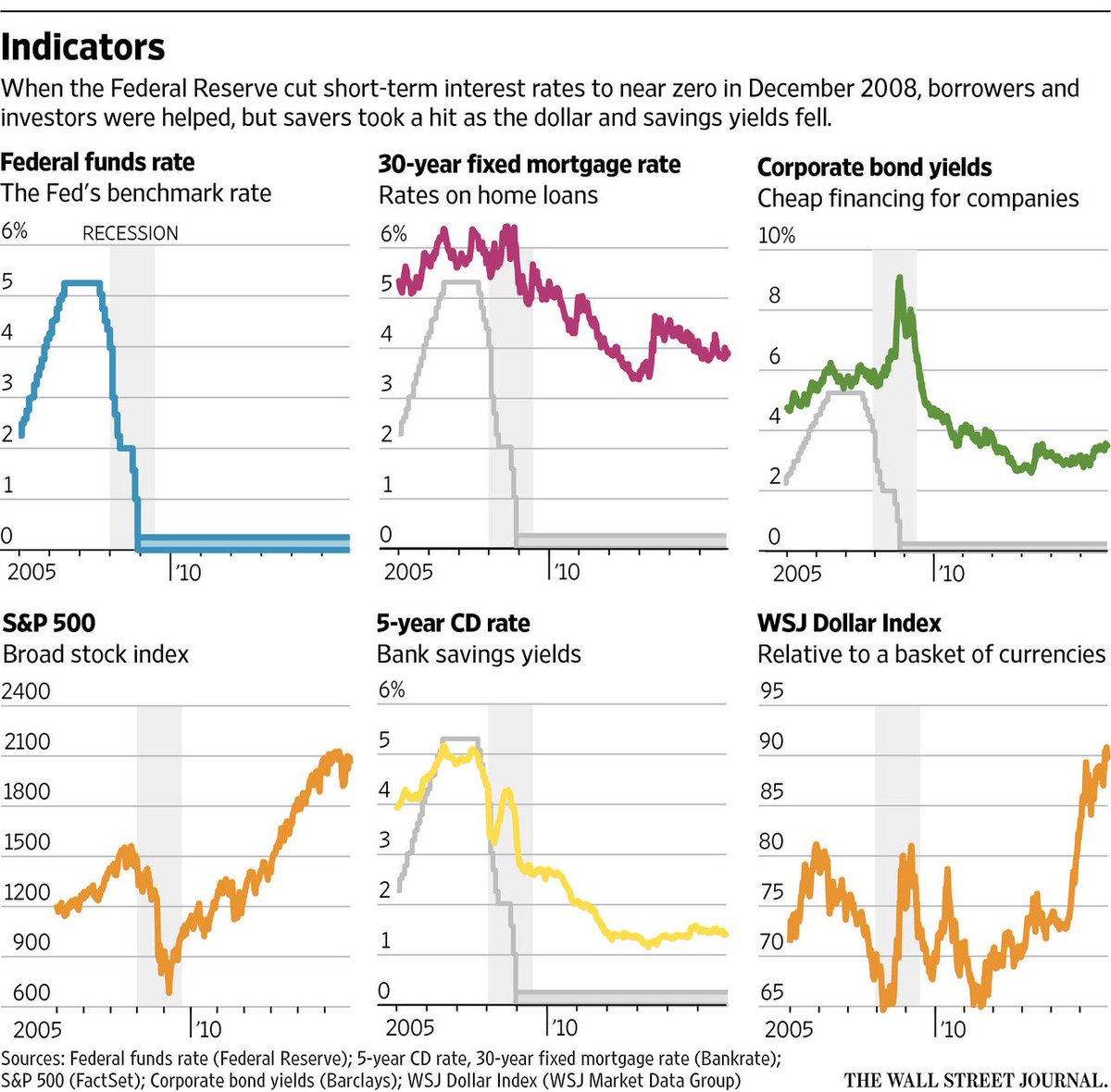

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!