The Genesis Of The Bubble's Bubble - "It's Financial Civil War, How Much You Bleed Is Up To You"

Authored by Richard Rosso via RealInvestmentAdvice.com,

The financial services industry is headed for the greatest debate in recent history.

Authored by Richard Rosso via RealInvestmentAdvice.com,

The financial services industry is headed for the greatest debate in recent history.

While the dollar and TSY yields both dropped to session lows shortly after the FOMC announcement hit as traders focused on the Fed disclosure that FOMC voters thought it prudent to await evidence an "economic slowdown is transitory" suggesting the committee still wanted to hike rates but was willing to wait for the certainty of data, Goldman's disagreed and according to a just released assessment by Goldman's Jan Hatzius, the statement was more hawkish than perceived by the market.

Having top-ticked US economic data with its March rate-hike, all eyes are on the May minutes to confirm the total lack of data-dependence now present at The Fed. The main focus of the minutes was on the 'normalization' of the balance sheet (since June hike odds are at 100%), which was confirmed with details of the plan revealed.

In today's FOMC Minutes, Fed member issued yet another explicit warning to America's investing public (before they pull the pin on the balance sheet normalization) about asset valuations beiung "vulnerable" and also piling on once again that commercial real estate values were "elevated."

Of course, traders don't care and have bid stocks to the highs of the day.

The Fed's explicit warning that "vulnerabilities have increased for asset valuation pressures."

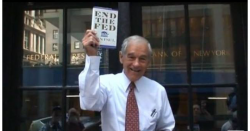

Gold and Silver Bullion Now Treated As Money In Arizona

by Ron Paul Liberty Report staff

Undermining the Federal Reserve received a major boost yesterday.

Arizona Governor Doug Ducey signed into law a bill that eliminates capital gains taxes on gold and silver, thus allowing Arizona residents to use precious metals as currency instead of Federal Reserve notes.