May Payrolls Preview: The Tiebreaker

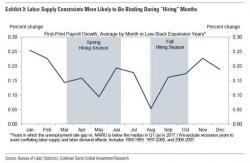

After a poor March jobs report, followed by an April scorcher, the May payrolls report due at 8:30am on Friday will be the tiebreaker, not only for the current state of the economy where both soft and hard data have been deteriorating in recent weeks, but perhaps also for the June rate hike decision, which as the Fed noted in its May FOMC minutes, may not take place without "evidence" that the recent "transitory weakness" in the economy is over. Here are the consensus expectations for tomorrow's report: