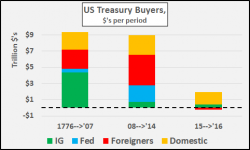

If The Fed Sells Treasuries... Who Will Be Buying? Answer: "Other" (Seriously)!

Authored by Chris Hamilton via Econimica blog,

Authored by Chris Hamilton via Econimica blog,

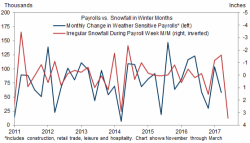

Here is the consensus for the key numbers the BLS will report at 8:30am ET on Friday morning

Bloomberg's ex-FX trader Richard Breslow is out with his daily dose of wisdom, and in his latest overnight note he urges fellow traders to "Try to Avoid Trading for All the Wrong Reasons", such as what happened overnight in Syria, which he believes is a non-event, and that today's other risk event, payrolls (as well as Trump-Xi) are far more relevant to asset prices:

Authored by Danielle DiMartino Booth,

Never underestimate the resourcefulness of a great plumber.

Had it not been for the genius of Thomas Crapper, champion inventor of the water-waste-preventing cistern syphon, Victorians would have been left to make their trek to that malodorous darker place otherwise known as the Out House, or perhaps the crockery pot stashed under the bed for a while longer.

The much anticipated March FOMC minutes were released today, and the minutes concluded exactly what I predicted in my last post titled "Is the Fed Trying to stop a "Market" that has gotten ahead of itself". In it I said that the only reason they were raising rates unexpectedly is because they are trying to slow the bubble from getting any bigger. The minutes confirmed that the February 'out of nowhere talk' of a rate hike, which led to a March rate hike, was all due to stocks and many other assets classes being a bubble.