Why The Market's "One-Sided Stability" Is Becoming Increasingly Dangerous: Deutsche Explains

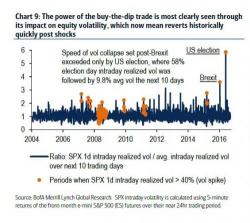

A topic that has been beaten to death both on these pages and virtually in every other financial website, has been the remarkable complacency in markets manifested, among other things, by near record low realized and implied equity vol, coupled with a recent plunge (if subsequent rebound) in cross-asset correaltions.