April Flashback: 75% Of Economists Expected June Hike

Submitted by Michael Shedlock via MishTalk.com,

When Will the Fed Act?

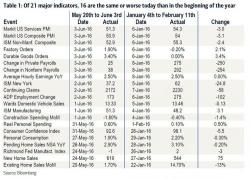

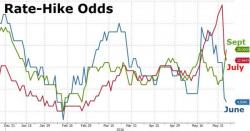

Given the massive swing in rate hike sentiment following the disastrous jobs report last week...

...Inquiring minds may be interested in how economists saw thing about a month ago.

On May 12, the Wall Street Journal too a survey of economists on the question When Will the Fed Act?