The Fed is too Reactionary to relatively minor events in setting Monetary Policy (Video)

By EconMatters

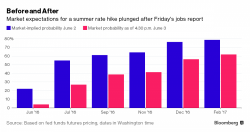

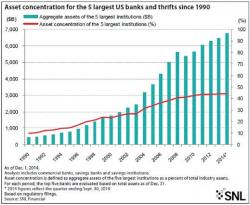

We delve into some of the recent criticisms of the Federal Reserve in this video. In response to whether the Fed is leading the market, or vice versa Lockhart states that it is a "Dance" regarding market expectations.