USAs BIG RED FOREX NUCLEAR OPTION

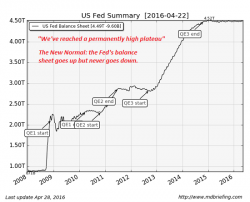

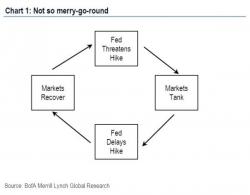

As we explain in our book Splitting Pennies - the world is not as we think! Every day, our money is worth less and less, and markets become more cumbersome, regulated, and overall disfunctional (except for an elite group of billionaires that can front run orders due to advanced computer-aided execution because of 'order types'). We explained in an article about America's Big Red Forex Button, now we need to elaborate on the 'nuclear option' - considering that leading generals are saying more and more that war with Russia is 'plausible' if not 'likely'.