The ECB Met With Goldman, Other Banks At Shanghai G-20 Meeting, Allegedly Leaking March Stimulus

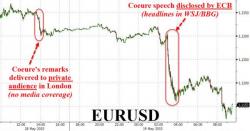

On May 18, 2015, the ECB's Benoit Coeure held a closed-door speech under "Chatham House" rules in which he leaked to an audience of hedge funds in London that "the central bank would moderately front-load its purchases in its quantitative easing program because of the seasonal lack of market liquidity in the summer." The reaction was an instant 50 pips drop in EURUSD as one or more funds decided to ignore the "rules", and promptly traded on the material, market moving leak.