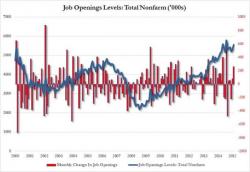

Is This Why Yellen Went Full-Dove: U.S. Hiring Plunges Most Since November 2008

While the BLS' JOLTs report usually gets a B-grade in terms of importance due to its one-month delayed look back (we just got the January report which is one month behind the most recent payrolls number) it serves an important function due to its breakdown of various labor components such a job openings, new hires, separations, quits and terminations, all of which make up Janet Yellen's "labor dashboard." In fact, according to Yellen herself, the JOLTs data is as important, if not more so, than the BLS report.