Why Currency Traders Are So Confused

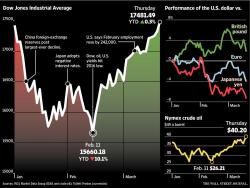

This morning the WSJ leads with an article that summarizes the prevailing market confusion at the moment, namely that global currencies are soaring, "defying central bankers" despite a flurry of easing around the globe in the past month, all of which have been undone by one Fed dot plot which cut the number of rate hikes forecast by Yellen & Co., from 4 to 2. To wit: "efforts by many of the world’s central banks to weaken their currencies are failing, raising concerns about whether policy makers are losing the ability to wield control over financial markets."