Even The Average Joe Gets It: "They’re Winding Us All Up For A Minsky Moment"

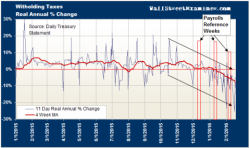

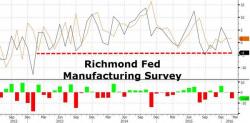

With global central bank policy in disarray following the Fed's now admitted "policy error" of tightening just as the US and global economy are heading for recession, while the rest of the world desperate to cut to ever more negative rates, not to mention Japan's abysmal foray into NIRP, there was hope that this weekend in Shanghai the G-20 would "bail us out" and unveil some miraculous rescue for risk takers at least one more time.