Is This How The Smart Money Is Betting On A Market Crash?

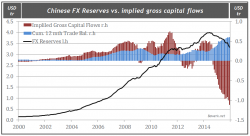

Instead of allocating capital to expensive tail risk bets on direct asset class collapse (in equities, credit, and commodities), it appears, just as we detailed previously, the 'smartest money in the room' is "betting" indirectly on a stock market crash through eurodollar options.

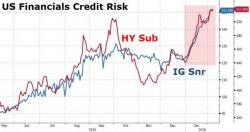

As we previously detailed, the costs of tail risk protection in credit and equity markets are soaring (and perhaps the crash in global financial stocks and spike in systemic credit risk supports that concerning possibility).