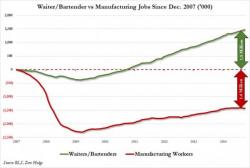

"The Job Gains Have Gone To The Least Educated, And Lowest-Paid, Workers"

One of the recurring themes in Obama's final State of the Union address was describing the strength of the economic recovery as witnessed by the number of job gains over the past 6 (if not exactly 7) years, clearly a purely quantitative metric. There was no discussion of the qualitative component of these job gains for one simple reason: as we have explained for years, the bulk of new labor has gone to undereducated, minimum wage (and often part-time) workers.