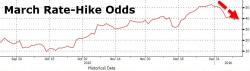

WTI Crude Collapses To $30 Handle, Stocks Plunge As Rate-Hike Odds Tumble

With rate hike odds for March plunging from over 55% a week ago to just 38% now, it appears faith in The Fed has utterly failed. WTI traded down to $30.97 - the lowest ssince Dec 2003.

Fed #Fail...

WTI punched lower to a $30 handle for the first time since December 2003..

and that has dragged stocks back into the red...