Can Another Fed Handout to Wall Street Stop the Market Bloodbath?

Stocks will likely rally this week for the simple reason that it is options expiration week.

The Fed almost always gives Wall Street extra money to play around with during options expiration.

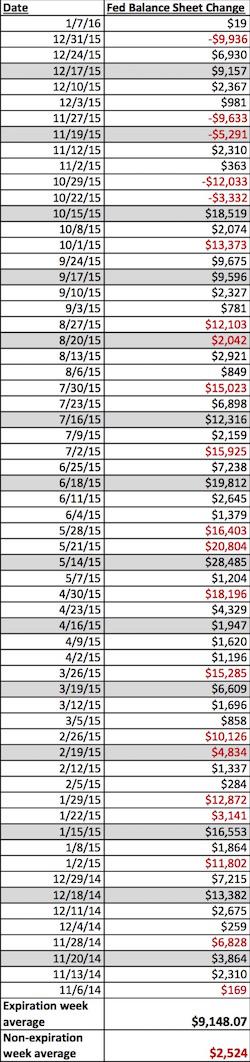

· On average the Fed expands its balance sheet by $9.1 billion during options expiration weeks.

· During non-options expiration weeks, the Fed contracts its balance sheet by an average of $2.5 billion.

Below is a table of the changes in the Fed’s balance sheet. Options expiration weeks are gray.