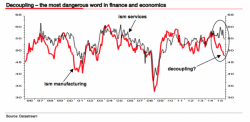

JPM's "Gandalf" Quant Is Back With A Startling Warning

Two days ago we reported that one half of JPM's Croatian "Duo of Doom", namely equity strategist Dubravko Lakos-Bujas, became every BTFDer's worst enemy when he said that the time of BTFDing is over, and a regime change has arrived one in which rallies are to be sold. To wit: