After 16 Months Without a 5% Market Pullback, Goldman's Clients Want To Know Just One Thing

It's confusing to be a Goldman client these days.

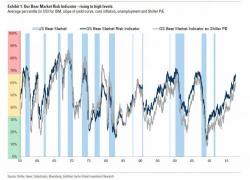

One month after the investment bank reported that its Bear Market Risk indicator had jumped to 67%, a level it hit most recently before the dot com bubble crash and just before the global financial crisis and prompted Goldman to ask "should we be worried now"...