Could the Next Fed Appointment Crush the Housing Market?

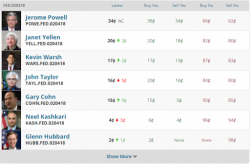

As the end of Federal Reserve Chairwoman Janet Yellen’s first term approaches, financial markets are beginning to digest the increased likelihood that US President Donald Trump will opt to appoint a more hawkish individual to the position. Even though the Federal Reserve is largely expected to continue tightening monetary policy over the coming months as it pares down the balance sheet and contemplates a dovish hike, Trump’s appointment could send shockwaves through the housing market.