Stocks Spooked By News Trump Interviewed John Taylor For Fed Chair Job

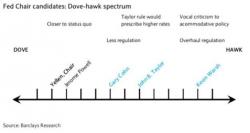

Many years ago, when it was still unclear who would replace then outgoing Fed chair Ben Bernanke, Zero Hedge endorsed John Taylor for the role of Fed chair: a futile endorsement as it had no chance of ever coming true due to Taylor's famous and long-running feud with the Fed over what the true Fed Funds rate should be, and the various pro forma adjustments the Fed imposed upon Taylor's own "Taylor Rule."