About That Debt Ceiling Crisis...

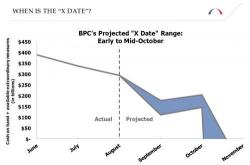

With just one month left until the "X Date", better known as the first day on which Treasury has exhausted its borrowing authority and no longer has sufficient funds to pay all of its bills in full and on time, and also known as the date the US is technically in default on its debt obligations and would be forced to prioritize debt payments according to that infamous 2011 Fed transcript...