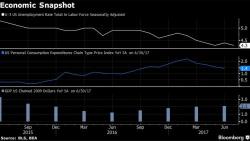

"It Is A Battle Between Data And Theory" - Fed PhDs Second-Guess Inflation Model After 5 Years Of Failure

Federal Reserve officials are finally waking up to the fact that there’s something wrong with their inflation models. It only took them five years.

As Bloomberg points out, the minutes from the Fed’s July policy meeting, released yesterday, included a debate about whether the models that help the central bank set its inflation target are no longer functioning properly.

“Federal Reserve officials are looking under the hood of their most basic inflation models and starting to ask if something is wrong.