El-Erian Warns Vexed Central Bankers "The Lowflation Demon Is Real"

Authored by Mohamed El-Erian via Bloomberg.com,

Authored by Mohamed El-Erian via Bloomberg.com,

Authored by Tho Bishop via The Mises Institute,

Ever since entering the Senate, Rand Paul has continued his father’s work in advocating for an audit of the Federal Reserve. This week, writing for the Daily Caller, Senator Paul renewed his efforts, illustrating how the recent era of unconventional monetary policy has made an audit all the more important:

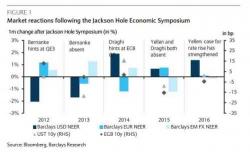

Historically the annual Jackson Hole symposium has been a major market-moving event as it has traditionally been the venue where central banks make critical announcements such as Bernanke's preview and hints of QE2 and QE3 in 2012, as well as Draghi's suggestion of the ECB's QE in 2014. As shown in the chart below, market reactions following these events have been material.

Cue the latest economic (and Phillips curve) paradox.

On one hand, the US unemployment rate is at a 16 year low of 4.4%, suggesting little if any slack in the US economy, and according to anecdotes from both the Fed's Beige Book and industry sources, labor shortages are so acute that - if one believes the recently discussed report from the NAHB - up to 75% of builders are unable to find construction workers.

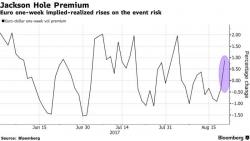

Absent any major geopolitical shocks, it is set to be a quiet summer week ahead with focus on the Jackson Hole conference. On the data front the key releases will be US durable goods and Eurozone PMIs, as well as Japan inflation & UK and Norway GDP. In Emerging Markets, there are monetary policy meetings in Indonesia, Hungary and Kazakhstan.