Key Events In The Coming Week: Payrolls, Core PCE, GDP, ISM And More

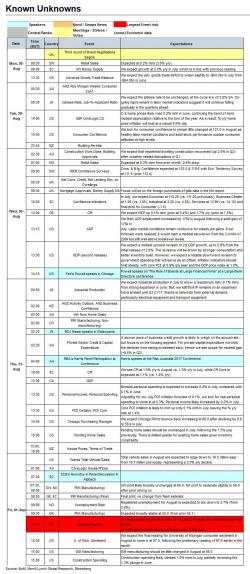

After last week's relatively quiet economic calendar and focus on Central Banks, when we finally heard from both Chair Yellen and Mario Draghi on Friday, attention this week turns back to data. In a relatively busy data week ahead - particularly for the US - focus will likely be on Friday's NFP, Q2 GDP revision on Wednesday, ISM manufacturing reports on Friday and inflation prints from the Eurozone.

Key events across the globe: