Stockman On Peak Bull: Fake Economy And Fake News

Authored by David Stockman via The Daily Reckoning,

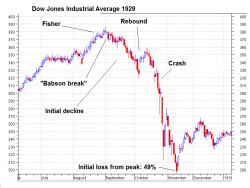

The American economy has been mangled by decades of assault on capitalist prosperity.

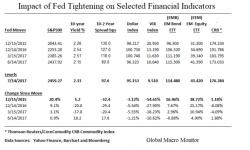

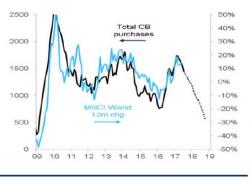

Growth is now dying because the Federal Reserve’s hit on corporate America that has strip-mined its balance sheets to feed the halls of Wall Street. Trillions of dollars have been thrown into financial engineering (stock buybacks, M&A deals and leveraged recaps) while neglecting real investment and productivity in Flyover America.