Bill Gross: A Recession Would "Probably Do The Economy Some Good"

Janus Portfolio Manager and purported “bond king” Bill Gross appeared on “Bloomberg Markets” to discuss his latest investor letter, in which he criticized loose-money policies of the world’s central banks, comparing them to gluttons who’ve feasted on bonds.

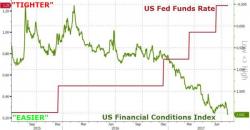

The unprecedented stimulus measures adopted by the Federal Reserve, the European Central Bank, the Bank of Japan and others have created distortions in markets, rendering widely followed historical models like the Philips Curve and Taylor rule useless, Gross said.