Don't Be Fooled - The Federal Reserve Will Continue Rate Hikes Despite Crisis

Authored by Brandon Smith via Alt-Market.com,

Authored by Brandon Smith via Alt-Market.com,

Authored by James Rickards via The Daily Reckoning,

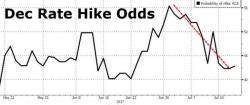

Last week the Fed raised the white flag on further rate hikes. There won’t be any for the foreseeable future.

No rate hikes are coming at the July, September or November Fed FOMC meetings. The earliest rate hike might be at the December 13, 2017 FOMC meeting, but even that has a less than 50% probability as of today. I’ll update those probabilities using my proprietary models in the weeks and months ahead.

Authored by Mark Melin via ValueWalk.com,

While central bank interest rate policy has been a relatively muted factor in stock market performance recently – successive rate hikes and hawkish Fed inclinations have mostly been warmly greeted by stock market advances – this pattern is about to change, predicts a July 18 Macquarie research report.

Authored by Ben Hunt via Epsilon Theory blog,

What do socialism and modern monetary policy have in common? Magical thinking. For both, it’s true on the giddy years up, and it’s true on the sad years down.

Authored by Frank Shostak via The Mises Institute,

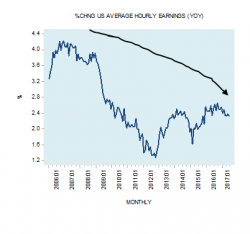

The yearly growth rate of average hourly earnings in production and non-supervisory employment in the private sector eased to 2.3% in June from 2.4% in May.

Many experts are puzzled by the subdued increase in workers earnings. After all, it is held the US economy has been in an expansionary phase for quite some time now.

Softer real output growth important reason why hourly earnings remain under pressure