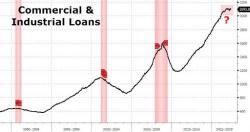

U.S. Weeks Away From A Recession According To Latest Loan Data

While many "conventional" indicators of US economic vibrancy and strength have lost their informational and predictive value over the past decade (GDP fluctuates erratically especially in Q1, employment is the lowest this century yet real wage growth is non-existent, inflation remains under the Fed's target despite its $4.5 trillion balance sheet and so on), one indicator has remained a stubbornly fail-safe marker of economic contraction: since the 1960, every time Commercial & Industrial loan balances have declined (or simply stopped growing), whether due to tighter loan supply or decl