Your Last Minute FOMC Preview: "Will It Be A Dovish Hike Or Not"

Courtesy of RanSquawk

Courtesy of RanSquawk

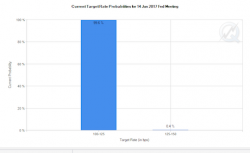

The Fed concludes its June meeting today. The Fed fund futures markets put the odds of the Fed hiking rates again at 99.6%.

This would mark the third rate hike by the Fed during this cycle.

Why would this matter?

Because it indicates the Fed is embarked on a serious tightening cycle. One rate hike can be a fluke. Two rate hikes could even be just policy error. But three rate hikes means the Fed is determined.

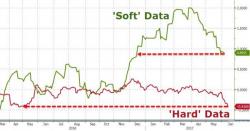

Disappointing inflation and retail sales data has sparked a surge in safe-haven demand for bonds and bullion, and left stocks confused this morning ahead of The Fed statement and press conference this afternoon...

A disastrous morning for US macro data - and yet we are assured by The Fed that a hike is overdue and everything is awesome...

It's not!

Gold and Bonds are well bid...

Pushing 10Y yield to its lowest since Nov 10th...

And Nasdaq jumped on the dovish-inspiring data dump...

Following a hotter than expected Core PPI, all eyes were on today's Consumer Price data (as RBC noted is more important for The Fed than PPI) which gravely disappointed the inflation-hoping crowd. Core PPI printed +1.7% (worse thasn expected 1.9%) and the weakest growth since Feb 2015.

May 2014 was the last time that Core PPI (Ex Food and Energy) was this high...With goods prices dropping but services rising.

But Consumer Price growth is plunging...Headline CPI dropped 0.1% MoM in May