Submitted by David Stockman via Contra Corner blog,

The giant credit fueled boom of the last 20 years has deformed the global economy in ways that are both visible and less visible. As to the former, it only needs be pointed out that an economy based on actual savings from real production and income and a modicum of financial market discipline would not build 65 million empty apartment units based on the theory that their price will rise forever as long as they remain unoccupied!

That’s the Red Ponzi at work in China and its replicated all across the land in similar wasteful investments in unused or under-used shopping malls, factories, coal mines, airports, highways, bridges and much, much more.

But the point here is that China is not some kind of one-off aberration. In fact, the less visible aspects of the credit ponzi exist throughout the global economy and they are becoming more visible by the day as the Great Deflation gathers force.

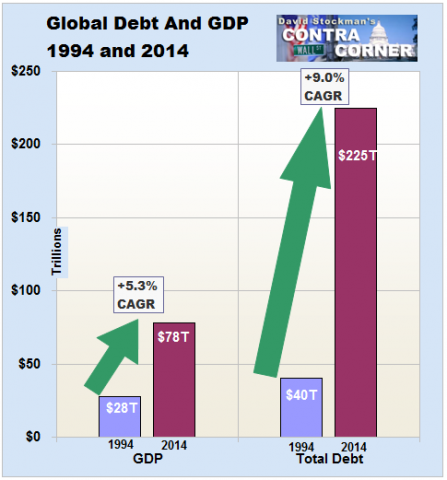

As we have regularly insisted, there is nothing in previous financial history like the $185 trillion of worldwide credit expansion over the last two decades. When this central bank fueled credit bubble finally reached its apogee in the past year or so, global credit had expanded by nearly 4X the gain in worldwide GDP.

Moreover, no small part of the latter was simply the pass-through into the Keynesian-style GDP accounting ledgers of fixed asset investment (spending) that is destined to become a write-off or public sector white elephant (wealth destruction) in the years ahead.

The credit bubble, in turn, led to booming demand for commodities and CapEx. And in these unsustainable eruptions layers and layers of distortion and inefficiency cascaded into the world economy and financial system.

One of these was an explosion of CapEx in the oil patch and the mining sector in response to massive price and margin gains and the resulting windfall rents on existing assets. In the case of upstream oil and gas, for example, worldwide investment grew from $250 billion to $700 billion in less than a decade.

Needless to say, there is now so much excess supply and capacity on the world market that oil has plunged into a collapse that is likely to last for years, as old investment come on-stream while world demand falters in the face of the gathering global recession. Already, investment is estimated to have dropped by 20% in 2015, and that is just the beginning.

This unfolding collapse of oil and gas investments, of course, will ricochet through the capital goods and heavy construction sectors with gale force. Eventually, annual investment may decline by $250 to $400 billion before balance is restored, meaning that what were windfall profits and surging wages and bonuses in these sectors just a year or two back will evaporate in the years ahead.

Contrary to the circular logic of our Keynesian central planners and Wall Street stock peddlers, the pending massive loss of value added capital spending in the energy patch is not a part of some grand reallocation game; it won’t be made up by households—-which are already at peak debt—— borrowing even more in order to go to the restaurant or yoga studio.

Instead, as the credit bubble begins to shrink it means that profits, incomes, balance sheets and credit-worthiness are all shrinking, too. So is the related GDP.

The same kind of malinvestment occurred in the mining sectors where Australia’s boom in iron ore, coal, bauxite and other industrial materials provides a good proxy. As shown below, CapEx in mining grew by nearly 6X in less than a decade.

But given the massive oversupply and plunging prices and margins in these commodities, and the overhang of still more capacity in the pipeline coming to completion, it is fair to say that investment in the global mining industry is sinking into a depression that will last the better part of a decade.

[image]https://www.mining.com/wp-content/uploads/2015/09/snl-capex-budgets-2015.jpg[/image]

Indeed, as shown above, global mining industry CapEx soared by 5X during the seven years through the 2012 peak, but the overwhelming share of that was in greenfield and brownfield investments. Yet given the massive global overcapacity in iron ore, copper, metallurgical coal, bauxite/alumina etc., those kinds of projects are likely to be few and far between in the years ahead.

Needless to say, that means shrinking profits and the massive loss of high wage jobs and vendor service contracts. Even baristas at Starbucks do not earn a fraction of what had been paid to miners and UAW members on the Caterpillar assembly line.

Nor was the credit-fueled CapEx boom limited to energy and metals. Bloomberg carried a story today outlining a similar super-cycle in the global rubber industry. As a result of massive rubber plantation expansion in response to soaring prices and windfall profits, the industry is now facing investment and job killing surpluses as far as the eye can see.

Global demand for natural rubber, used mostly in tires, is slowing as the economy cools in China, the world’s largest buyer of new cars. Supplies are expanding after a decade-long rally in prices to a record in 2011 encouraged top producers like Thailand, Indonesia and Vietnam to plant more trees. Output will exceed use for two more years, with the surplus quadrupling in 2016, according to The Rubber Economist Ltd., a London-based industry researcher.

……Rubber traded in Tokyo, a global benchmark, has tumbled 70 percent from a record in 2011, touching a six-year low of 153 yen ($1.26) a kilogram on Nov. 6. Futures in Shanghai have slumped 22 percent in 2015. The export price from Thailand, the top producer, is down 23 percent…..

Global production is set to exceed demand by 411,000 metric tons next year and by 430,000 tons in 2017, compared with a surplus of 98,000 tons in 2015, The Rubber Economist predicted on Dec. 9. Output will increase 3.8 percent next year to 13 million tons and will keep expanding through 2018, the researcher said. Consumption won’t grow nearly as fast, which will leave stockpiles by the end of 2017 at a record 3.7 million tons, said Prachaya Jumpasut, managing director of The Rubber Economist.

Excess supplies may keep prices subdued for a decade, said Hidde Smit, an industry adviser who has studied the market for more than 30 years and is the former secretary-general of the International Rubber Study Group. Even with some smaller farms cutting back now, the planted area across 11 Asian countries that are the primary growers has surged 45 percent since 2004, he said.

[image]https://assets.bwbx.io/images/ij7aCSJsw7Go/v2/-1x-1.png[/image]

So with producer profits and incomes falling in commodity sectors and capital goods industries all over the world, there is no prospect of a smooth rotation into more services and consumption. Deflation means not just lower oil or steel prices; it also means the evaporation of production and incomes which were falsely inflated by the 20-year credit binge.

And that’s not the half of it. The massive windfalls on commodities and capital goods earned by producers during the great credit inflation were not entirely reinvested in new capacity and fixed assets. As the Wall Street Journal documented recently, it also enabled a huge increase in the balance sheets of sovereign wealth funds due to state ownership or heavy taxation of oil and mineral production.

But now the days of heady accumulation of “sovereign wealth” in Saudi Arabia, Norway, Kazakhstan and dozens of commodity producers in between is over and done. What is happening is that these funds are entering a cycle of liquidation which is unprecedented in financial history.

Indeed, the data for Saudi Arabia, Qatar, Kuwait, the UAE and other members of the Gulf Cooperation Council (GCC) is stunning. During the global credit boom they amassed sovereign wealth funds totaling $2.3 trillion. But with deficits now estimated at 13% of GDP and rising, the level of asset liquidation is soaring.

Thus, if crude oil prices recover to $56 per barrel next year, the GCC states will need to liquidate $208 billion of investments. Yet if prices fall to $20 per barrel, as Goldman Sachs has warned, they would need to liquidate nearly $500 billion of their booty in a single year.

But regardless of the exact crude oil path in the years ahead, prices are sure to stay in the sub-basement for an extended period. That means that the GCC states may need to liquidate the entirety of their sovereign wealth funds by early in the next decade.

[image]https://si.wsj.net/public/resources/images/P1-BV822_SWF_16U_20151222175715.jpg[/image]

The same is true on a worldwide basis for all of the energy and mineral based sovereign wealth funds. They will be in a liquidation mode for years to come as the great commodity deflation runs its course.

In a word, the unnatural Big Fat Bid of the sovereign wealth funds is going All Offers as oil and commodity producers struggle to fund their budgets.

Stated differently, just as the commodity bubble effects did not stay contained in the energy and metals markets as the global credit bubble expand, the same will be true in the deflation cycle.

The unfolding correction of the visible excesses of the credit inflation - such as overinvestment and malinvestment - will destroy incomes and profits; the Great Unwind of the less visible effects, such as the sovereign wealth fund liquidations, are a giant pin aimed squarely at the monumental worldwide bubbles in stock, bonds and real estate.