Written By Jenna Ross

Graphics & Design

- Pernia Jamshed

Published May 24, 2023

•

Updated May 24, 2023

•

The following content is sponsored by New York Life Investments

Reimagining the 60/40 Portfolio for Today’s Market

The 60/40 portfolio failed to protect investors from the volatile market of 2022. As economic conditions change, is it time to rethink the balanced portfolio?

This graphic from New York Life Investments highlights the current circumstances investors face, and a new 60/40 allocation that has historically produced higher risk-adjusted returns.

Nowhere for Investors to Hide

From 1977-2022, stocks and bonds had an average correlation of only 0.3. This weaker relationship between their market movements has helped reduce losses when one asset class performs poorly.

However, stocks and bonds both dropped in value in 2022, indicating a high degree of correlation between the two asset classes. The 60/40 portfolio—60% stocks and 40% bonds—lost nearly 17%, driven primarily by the Federal Reserve’s rapid rate hikes. It was the worst performance since the 2008 financial crisis.

| Year | 60/40 Portfolio Return | Correlation |

|---|---|---|

| 2022 | -16.9% | 0.7 |

| 2021 | 15.5% | -0.1 |

| 2020 | 12.8% | 0.2 |

| 2019 | 20.8% | 0.4 |

| 2018 | -3.7% | -0.1 |

| 2017 | 13.1% | 0.2 |

| 2016 | 6.8% | 0.3 |

| 2015 | -0.2% | 0.4 |

| 2014 | 9.2% | 0.6 |

| 2013 | 17.0% | -0.1 |

| 2012 | 9.7% | 0.3 |

| 2011 | 3.1% | -0.1 |

| 2010 | 10.3% | 0.4 |

| 2009 | 16.4% | 0 |

| 2008 | -21.0% | -0.4 |

| 2007 | 4.9% | 0.7 |

| 2006 | 9.9% | 0.4 |

| 2005 | 2.8% | 0.5 |

| 2004 | 7.1% | 0.6 |

| 2003 | 17.5% | -0.1 |

| 2002 | -9.9% | -0.9 |

| 2001 | -4.4% | -0.8 |

| 2000 | -1.4% | 0.4 |

| 1999 | 11.4% | 0.1 |

| 1998 | 19.5% | 0.7 |

| 1997 | 22.5% | 0.9 |

| 1996 | 13.6% | 0.7 |

| 1995 | 27.9% | 0.9 |

| 1994 | -2.1% | 0.8 |

| 1993 | 8.1% | 0.9 |

| 1992 | 5.6% | 0.7 |

| 1991 | 22.2% | 0.6 |

| 1990 | -0.4% | 0.3 |

| 1989 | 22.2% | 0.9 |

| 1988 | 10.6% | -0.1 |

| 1987 | 2.3% | 0.2 |

| 1986 | 14.9% | 0.9 |

| 1985 | 24.6% | 0.9 |

| 1984 | 6.9% | 0.2 |

| 1983 | 13.7% | 0.9 |

| 1982 | 21.9% | -0.1 |

| 1981 | -3.3% | -0.1 |

| 1980 | 16.5% | 0.1 |

| 1979 | 8.2% | 0.6 |

| 1978 | 1.2% | 0.1 |

| 1977 | -5.7% | -0.3 |

Portfolio return based on 60% S&P 500 Index, 40% Bloomberg U.S. Aggregate Bond Index. Correlation based on monthly changes over trailing 12 months, annual average.

Despite the bear market conditions in 2022, it’s important to understand the long-term strengths of a 60/40 portfolio.

Balancing Risk and Return

A 60/40 portfolio may be best suited for investors with moderate risk tolerance and moderate return expectations.

As the market ebbs and flows, diversifying into both stocks and bonds is intended to smooth out returns. Compared to a 100% stock portfolio from 1977-2022, a balanced portfolio has earned slightly lower average returns while experiencing 33% less risk.

| 100% Stock Portfolio | 60/40 Portfolio | |

|---|---|---|

| Biggest Annual Loss | -38.5% | -21.0% |

| Average Annual Return | 9.4% | 8.3% |

| Standard Deviation (Risk) | 16.1% | 10.7% |

The 100% stock portfolio is represented by the S&P 500 Index. The 60/40 portfolio is 60% S&P 500, 40% Bloomberg U.S. Aggregate Bond Index. Standard deviation is based on annual returns.

Investors may want to consider the potential risk-adjusted return advantage of a 60/40 portfolio given the current economic environment.

A Changing Economic Landscape

After decades of low and relatively stable rates, we may be entering a period of moderate interest rates and inflation. Inflation has been slowing down, but the current rate is two times higher than the average since 2000.

In addition, according to the International Monetary Fund, it is likely that economic growth will be more volatile and uncertain. The probability of a U.S. recession within the next 12 months is also quite high: The Conference Board’s recession probability indicator reached 0.99 in February 2023. Since 2007, a recession has followed any time the indicator has climbed above 0.40.

In this environment, investors may benefit from a different set of tools than those that succeeded in the last cycle.

Mixing it Up: A New 60/40 Portfolio Allocation

With current circumstances and historical performance in mind, New York Life Investments has reimagined the 60/40 portfolio.

This allocation, excluding satellite exposure, earned the highest risk-adjusted return from 1973-2022 based on historical modeling. Satellites are actively managed, non-core parts of a portfolio and can be used to tailor investor preferences to the current macroeconomic environment.

| Asset | Portfolio Allocation |

|---|---|

| High Dividend-Yielding Equity | 30% |

| Value Equity | 10% |

| Large Cap Equity | 10% |

| Stock Satellite: Infrastructure Equity | 5% |

| Stock Satellite: Currency Hedged International Equity | 5% |

| Core Bonds | 25% |

| Municipal or Corporate Bonds | 10% |

| Bond Satellite: Short Duration High-Yield Securities OR Taxable Municipal Bonds | 5% |

Sample portfolios, excluding satellites, were modeled and ranked on risk-adjusted monthly return (Sharpe Ratio). Portfolios assumed annual rebalancing. Satellites could not be modeled into the historical analysis due to shortened time frames in the existence of reliable data.

For a bond satellite, short duration high-yield securities may be appropriate if interest rates continue to rise or maintain their current levels. Alternatively, taxable municipal bonds may provide quality, long-dated duration with an attractive yield potential for investors who want to hedge against falling returns.

When it comes to a stock satellite, infrastructure equity offers a potential inflation hedge and exposure to a structural and global investment theme. In addition, currency hedged international developed markets’ equity diversifies economic cycle exposure and acts as a potential hedge against a strengthening U.S. dollar.

Importantly, the reimagined portfolio should be taken as a starting point. Investors should work with their financial professional to tailor their portfolios to their needs. By diversifying within asset classes and considering the current economic environment, investors can target higher risk-adjusted returns.

Learn more about the new 60/40 portfolio.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #risk-adjusted return #Recession #inflation #stocks #bonds #New York Life Investments #60/40 portfolio #balanced portfolio

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Reimagining the 60/40 Portfolio for Today’s Market";

var disqus_url = "https://www.visualcapitalist.com/sp/reimagining-the-60-40-portfolio-for-todays-market/";

var disqus_identifier = "visualcapitalist.disqus.com-158115";

You may also like

-

Politics7 days ago

Charting the Rise of America’s Debt Ceiling

By June 1, a debt ceiling agreement must be finalized. The U.S. could default if politicians fail to act—causing many stark consequences.

-

Education1 week ago

Ranked: The World’s Top 50 Endowment Funds

Endowment funds represent the investment arms of nonprofits. See the worlds top 50, which collectively have over $1 trillion in assets.

-

Demographics1 week ago

Visualizing the American Workforce as 100 People

Reimagining all 200 million of the American workforce as 100 people: where do they all work, what positions they hold, and what jobs they do?

-

Markets3 weeks ago

Visualized: Real Interest Rates by Country

What countries have the highest real interest rates? We look at 40 economies to analyze nominal and real rates after projected inflation.

-

Central Banks1 month ago

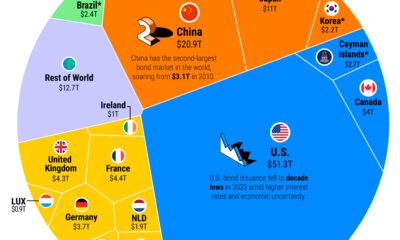

Ranked: The Largest Bond Markets in the World

The global bond market stands at $133 trillion in value. Here are the major players in bond markets worldwide.

-

Markets2 months ago

Visualized: The Largest Trading Partners of the U.S.

Who are the biggest trading partners of the U.S.? This visual showcases the trade balances between the U.S. and its trading partners.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 380,000+ subscribers who receive our daily email *Sign Up

The post Reimagining the 60/40 Portfolio for Today’s Market appeared first on Visual Capitalist.