Submitted by David Stockman via Contra Corner blog,

First there were seventeen. At length, there was one.

Donald Trump’s wildly improbable capture of the GOP nomination, therefore, is the most significant upheaval in American politics since Ronald Reagan. And the proximate cause is essentially the same. Like back then, an era of drastic bipartisan mis-governance has finally generated an electoral impulse to sweep out the stables.

Accordingly, the Donald’s patented phrase that “we aren’t winning anymore” is striking a deep nerve on main street. But that is not on account of giant trade deficits or a faltering foreign policy and failed military adventures per se.

Indeed, it has very little to do with any patriotic impulse with respect to America’s collective polity, and everything to do with voter perceptions that they personally are not winning economically anymore, either.

What is winning is Washington, Wall Street and the bicoastal elites. The latter prosper off finance, the LA branch of entertainment (movies and TV), the SF/technology branch of entertainment (social media) and the great rackets of the Imperial City—including the military/industrial/surveillance complex, the health and education cartels, the plaintiffs and patent bar, the tax loophole farmers and the endless lesser K-Street racketeers.

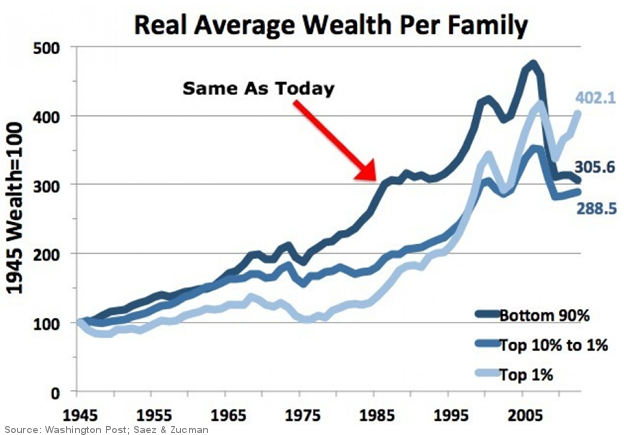

Consequently, most of America’s vast flyover zone has been left behind. Thus, the bottom 90% of families have no more real net worth than they had 30 years ago. By contrast, the real net worth of the top 9% stands at 150% its 1985 level, and the very top 1% is at 300% of its level three decades ago.

Moreover, the wealth round trip of the bottom 90% depicted in the chart below was hardly real in the first place. Main Street net worth temporarily soared owing to Greenspan’s 15-year housing bubble which culminated in the great financial crisis. What is left is mainly the mortgage debt.

The same pattern is evident in real household incomes and average real earnings of full time workers. In this case, the metric displayed in the chart encompasses men over 16 to control for changes in the work force mix, but the result is unmistakable. To wit, real median household incomes in 2014 were no higher than the level first reached in 1989, and real weekly full-time wages were actually 4% lower.

In a similar vein, Indiana was supposed to be Senator Cruz’ last stand, but according to the pundits he ended up getting blown away by the “Carrier” vote. United Technology’s plan to move its air conditioner factory to Mexico became Donald Trumps whipping boy, but the metaphor had deep resonance.

Since the year 2000, the US has lost 20% of its highest paying full-time jobs in the goods producing economy—–that is, energy and mining, construction and manufacturing.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/04/5-480x301.png[/image]

Even when you allow for the supposed shift to white collar jobs in finance, technology, entertainment and other domestic services, the story is pretty much the same. There are still nearly 2 million fewer full-time, full pay “breadwinner jobs” in the US today than when Bill Clinton was packing his bags to leave the White House in January 2001.

These jobs currently pay an equivalent annual wage of $50,000 on average, which isn’t affluence by any means. But the point is, these jobs are the best of what we have and the total has been going nowhere for the last decade and one-half, even as the adult population (over 16 years) has risen from 212 million to 250 million.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/04/1-480x298.png[/image]

Stated differently, the Trump voters don’t watch CNBC. Or if they do, they are savvy enough to dismiss it’s specious celebration of America’s phony bicoastal prosperity, and especially the monotonously stupid and profoundly misleading ritual of Jobs Friday. The voters know from experience that those millions of “new jobs” are mainly part-time gigs that come and go between the financial crashes that arise every seven years or so out of Wall Street and Washington.

Indeed, these bread and circuses jobs may all be part of the “print” according to Keynesian windbags like Mark Zandi, but the flyover zone voters know the real truth. They pay cash wages of less than $20,000 per year on a full-time equivalent basis, offer virtually no benefits and are scheduled by the day and hour.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/04/6-480x300.png[/image]

In fact, nearly 40% of all the net payroll jobs created since the year 2000 are in what we have called the Part Time Economy. Trump voters have gotten stuck in them, fear they will end up there or have friends and family who have no other opportunities.

Needless to day, they know they are not winning.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/04/4-480x298.png[/image]

Meanwhile, the bicoastal elites tend to their increasingly fanciful projects and provocations. That is to say, Imperial Washington’s completely trumped up campaign against Russia and Putin is cut from the same cloth as Silicon Valley’s pretension that there are ( or were until February) 147 “unicorn” start-ups that are each worth a billion dollars or more—notwithstanding that few of them have meaningful revenues, cognizable business models or any prospect of earning a profit.

Everywhere the governing institutions are whistling past the graveyard, yet have become so insular and removed from accountability that they are clueless about their own impending doom. The Federal Reserve, for example, has now fueled the mother of all financial bubbles after seven years of non-stop money printing and radical interest rate repression, but nevertheless believes that the nirvana of full employment prosperity is just around the corner.

Likewise, US military intervention has failed in every Muslim land it has bombed, droned or occupied. Yet the White House is still sending more bootless boots to these decimated lands, thereby insuring even more blowback and gifting jihadist recruiters with endless fodder for outrage and revenge.

So too, a seven year “recovery” cycle has been squandered on the fiscal front. While Obama was taking bows for cutting the deficit in half and Republicans were joining in to gut the discretionary spending sequester, the fiscal time bomb of entitlements continued to tick unattended.

The fact is, nominal GDP is now growing at only 3% per year, and in a world of relentless deflation owing to the end of the great central bank credit bubble, there is no prospect that it will accelerate. Accordingly, by 2026 GDP will be $24 trillion under the best of circumstances, while the national debt will rise by $9 trillion per CBO’s Keynesian reckoning or upwards of $15 trillion if you believe the Fed has not abolished the business cycle.

That’s right. The virtually guaranteed national debt of $30-$35 trillion will reach an Italian style 140% of GDP just as the baby boom retirement wave hits full stride.

So when Trump says that Uncle Sucker is broke, the public believes him. It happens to be true.

Finally, the greatest bicoastal scam is the rampant Bubble Finance prosperity of Wall Street and Silicon Valley. Let’s face it. Facebook——along with Instagram, Whatsapp, Oculus VR and the 45 other testaments to social media drivel that Mark Zuckerberg has acquired with insanely inflated Wall Street play money during the last few years——-is not simply a sinkhole of lost productivity and low-grade self-indulgent entertainment. Faceplant is also a colossal valuation hoax.

Why? Because at bottom, FB is just an Internet billboard. It’s a place where mostly millennials idle their time in or out of their parents’ basement. Whether they grow tired of Facebook or not remains to be seen, but one thing is certain.

To wit, Facebook has invented nothing, has no significant patents, delivers no products and generates no customer subscriptions or service contracts. Its purported 1.8 billion “MAUs” (monthly average users) are fiercely devoted to “free stuff” in their use of social media.

Therefore, virtually all of its revenue comes from advertising. But ads are nothing like a revolutionary new product such as Apple’s iPhone, which can generate tens of billions of sales out of nowhere.

The pool of advertising dollars, by contrast, is relatively fixed at about $175 billion in the U.S. and $575 billion worldwide. And it is subject to severe cyclical fluctuations. For instance, during the Great Recession, the U.S. advertising spend declined by 15% and the worldwide spend dropped by 11%.

And therein lies the skunk in the woodpile. Due to its sharp cyclicality, the trend growth in U.S. ad spending has been about 0.5% per annum. Likewise, the global ad spend increased from about $490 billion in 2008 to $575 billion in 2015, reflecting a growth rate of 2.3% annually.

Yes, there has been a rapid migration of dollars from TV, newspapers and other traditional media to the digital space in recent years. But the big shift there is already over.

Besides that, you can’t capitalize a one-time gain in sales of this sort with even an average market multiple. And that’s to saying nothing of FB’s of the fact that FB’s current $340 billion market cap represents a preposterous multiple of 211 times its $1.6 billion of LTM free cash flow.

In any event, the digital share of the U.S. ad pool rose from 13.5% in 2008 to an estimated 32.5% last year. But even industry optimists do not expect the digital share to gain more than a point or so per year going forward. After all, television, newspapers, magazines and radio and highway billboards are not going to disappear entirely.

Consequently, there are not remotely enough advertising dollars in the world to permit the endless gaggle of social media space entrants to earn revenue and profits commensurate with their towering valuations and the sell side’s hockey stick growth projections. In social media alone, therefore, there is more than $1 trillion of bottled air.

But the social media billionaire brats are not the half of it. The central bank money printers have transformed Wall Street into a nonstop casino that has showered a tiny slice of hedge funds and speculators with unspeakable windfalls from the likes of monstrosities like Valeant and hundreds of similar momentum bubbles.

Just consider the shameless mountebank who has conjured the insane valuation of Tesla from the gambling pits of Wall Street. The company has never made a profit, never hit a production or sales target and has no chance whatsoever of becoming a volume auto producer.

Yet after posting another wider than expected $283 million loss in the first quarter, which was nearly twice last year’s red ink, Elon Musk doubled-down on his snake oil offering. His promise that Tesla would become cash flow positive in 2016, after burning through $4 billion in cash since 2008, was abruptly declared inoperative. Instead, Tesla will do another giant dilutive capital raise in order to fund an acceleration of the Model 3 so that it can deliver 500,000 vehicles in 2018.

That’s a con job worthy of the seediest use car lot in America. In auto production land, today is already 2018 in the case of a mass production vehicle that has barely been designed, and which has not yet been production engineered, tooled, tested or sourced for components and materials.

Indeed, the idea that a company which produced just 50,000 vehicles in the last 12 months can scale up to 10X that volume virtually over night on a production line and supply system that does not even exist is a laughable fiction. But what isn’t laughable is that the Wall Street casino is so blinded by speculation, greed and Fed puts and liquidity pumping that it is enabling dozens of circus barkers like Elon Musk to inflate spectacular bubbles which will end up destroying the main street homegamers who fall for them, and dissipating loads of scarce capital in the process.

The fact is, the bicoastal elites have been showered with stupendous windfalls since the March 2009 bottom because the Fed has engineered through ZIRP, QEs, puts and open mouth cheerleading a systematic falsification of financial prices and the diversion of massive amounts of new debt and other capital into rank financial speculation.

On a net basis, for example, virtually the entirety of the $2 trillion in incremental business debt raised since 2007 (from $11 trillion to $13 trillion) has been cycled into stock buybacks, wildly over-priced M&A deals and other forms of financial engineering which result in the bidding up of existing equities, not the investment of new funds into productive assets. Indeed, the C-Suites of corporate America have been transformed into stock trading rooms.