Subscribe to the Advisor Channel free mailing list for more like this

The Top Investments Used by Financial Advisors

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

Today, financial advisors are re-evaluating how they build client portfolios as the economic environment evolves.

Following a decade of historically low interest rates, the U.S. economy is now characterized by higher interest rates, driven by inflationary pressures. This has been met with stronger bond returns and a more cautious view on stocks as companies face steeper borrowing costs.

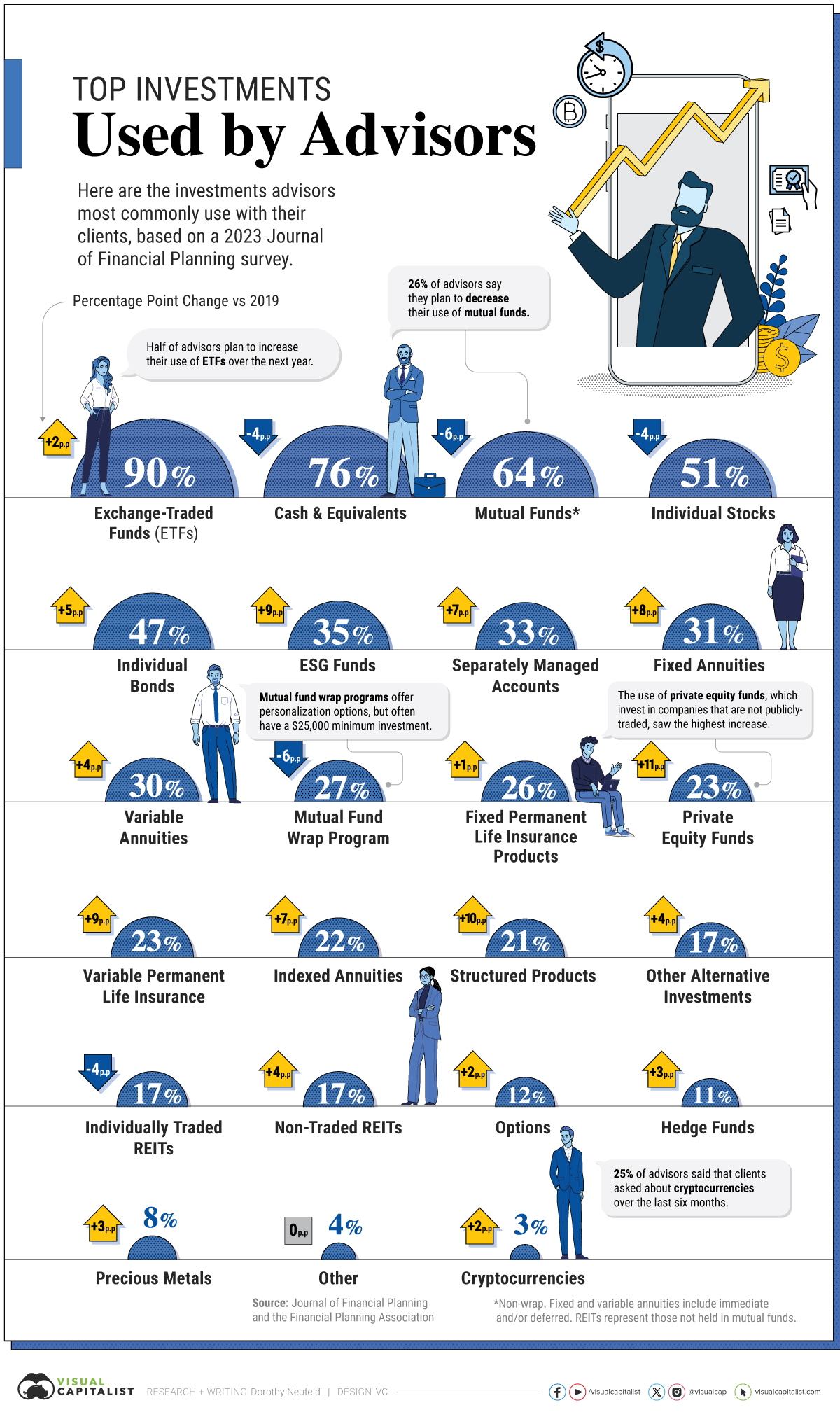

This graphic shows the top investments used by advisors, based on a 2023 Journal of Financial Planning survey.

Top Investments in 2023

Below, we show the most common types of investments advisors used or recommended to their clients this year:

| Investment Type | 2023 | 2019 |

|---|---|---|

| Exchange-Traded Funds (ETFs) | 90% | 88% |

| Cash and Equivalents | 76% | 80% |

| Mutual Funds* | 64% | 70% |

| Individual Stocks | 51% | 54% |

| Individual Bonds | 47% | 42% |

| ESG Funds | 35% | 26% |

| Separately Managed Accounts | 33% | 26% |

| Fixed Annuities | 31% | 23% |

| Variable Annuities | 30% | 26% |

| Mutual Fund Wrap Programs | 27% | 32% |

| Fixed Permanent Life Insurance Products | 26% | 24% |

| Private Equity Funds | 23% | 12% |

| Variable PermanentLife Insurance | 23% | 14% |

| Indexed Annuities | 22% | 15% |

| Structured Products | 21% | 11% |

| Other Alternative Investments | 17% | 13% |

| Individually Traded REITs | 17% | 20% |

| Non-Traded REITs | 17% | 13% |

| Options | 12% | 9% |

| Hedge Funds | 11% | 8% |

| Precious Metals | 8% | 5% |

| Other | 4% | 4% |

| Cryptocurrencies | 3% | 0% |

*Non-wrap. Numbers have been rounded.

As the above table shows, 90% of advisors use ETFs, and almost half reported they plan to increase their usage in the 12 months ahead.

Cash and equivalents, such as money market funds, were also widely used. Yet since 2019, use by advisors declined by four percentage points.

Money market funds saw a record $5.9 trillion in assets under management as of December, averaging returns of about 4.5%. Meanwhile, the S&P 500 has returned roughly 24% year-to-date and investment bonds have returned over 5%.

The use of private equity funds, which invest in privately-held companies, saw the highest increase across investment types, rising 11 percentage points as some advisors looked to alternative investments.

On the other hand, the sharpest decline was across mutual funds, falling six percentage points. Over a quarter of respondents say that they plan to decrease utilizing them in the next year.

Interestingly, 3% of advisors use cryptocurrencies with their clients. To date, Bitcoin has returned over 164%.

Advisor Views on the 60/40 Portfolio

Is the 60/40 portfolio dead?

After a rocky year in 2022, the time-honored 60% stock and 40% bond portfolio has returned 13% to date as of December. When surveyed, more advisors were confident than doubtful that it could offer similar returns compared to history.

| Confidence That a 60/40 Portfolio Can ProvideSimilar Returns as it Has Historically | Percent of Respondents |

|---|---|

| Very Confident | 16% |

| Confident | 28% |

| Somewhat Confident | 27% |

| Neutral | 7% |

| Somewhat Doubtful | 14% |

| Doubtful | 4% |

| Very Doubtful | 3% |

Percentages may not equal 100 due to rounding.

In fact, JP Morgan projects that a 60/40 portfolio will outperform cash by 4.1 percentage points on an annualized basis, and outpace inflation by 4.5 percentage points over the next decade.

According to their estimates, $100 in cash is forecast to grow to $133 over 10 years, while a 60/40 portfolio is projected to be worth $197.

Although the high interest rate climate has increased returns on cash, it misses out on the value of compounding offered by other types of investments over a longer horizon.

The post Visualizing the Top Investments Used by Financial Advisors appeared first on Visual Capitalist.